MiCA and Beneficial Ownership: Compliance Obligations Explained

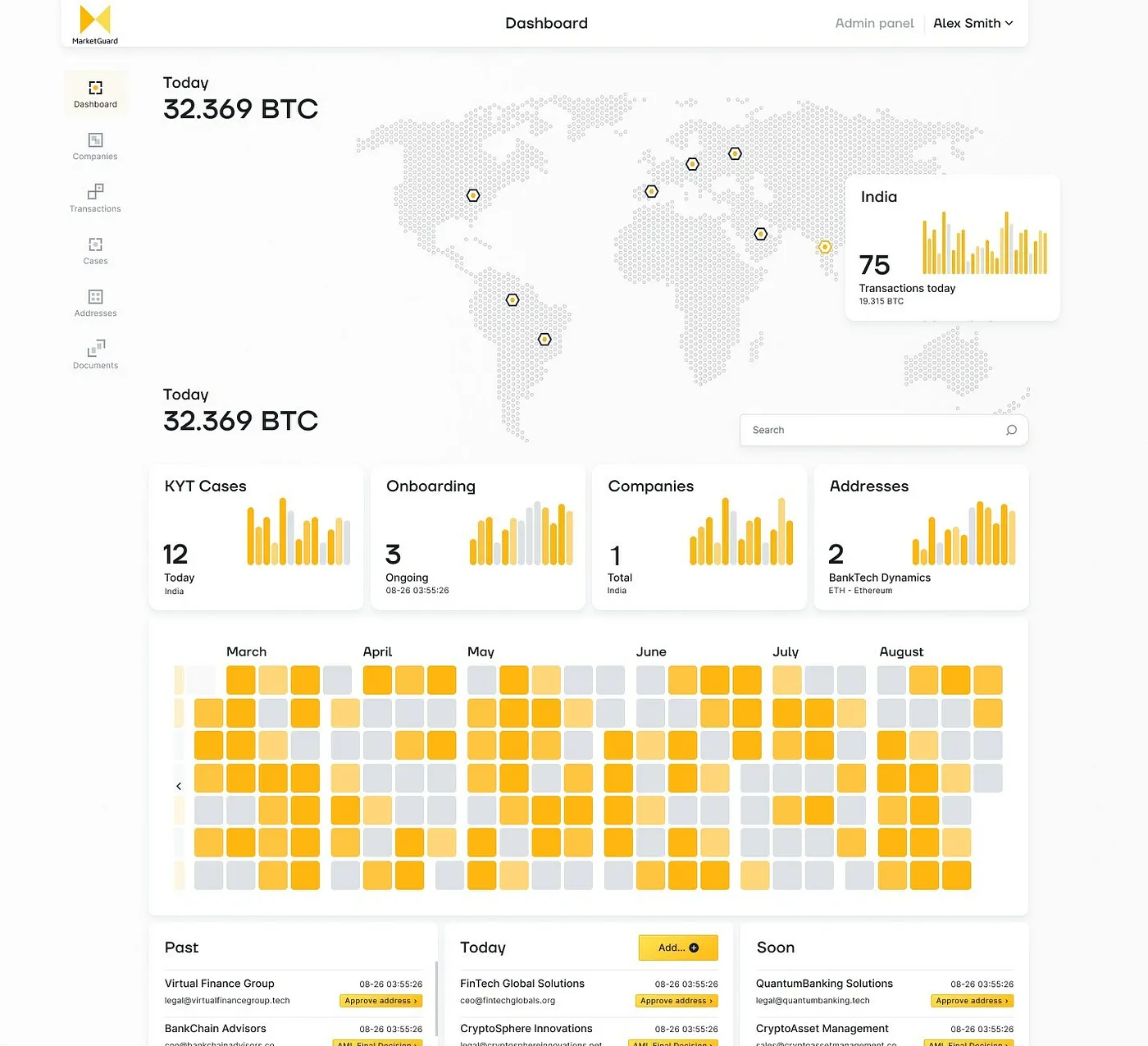

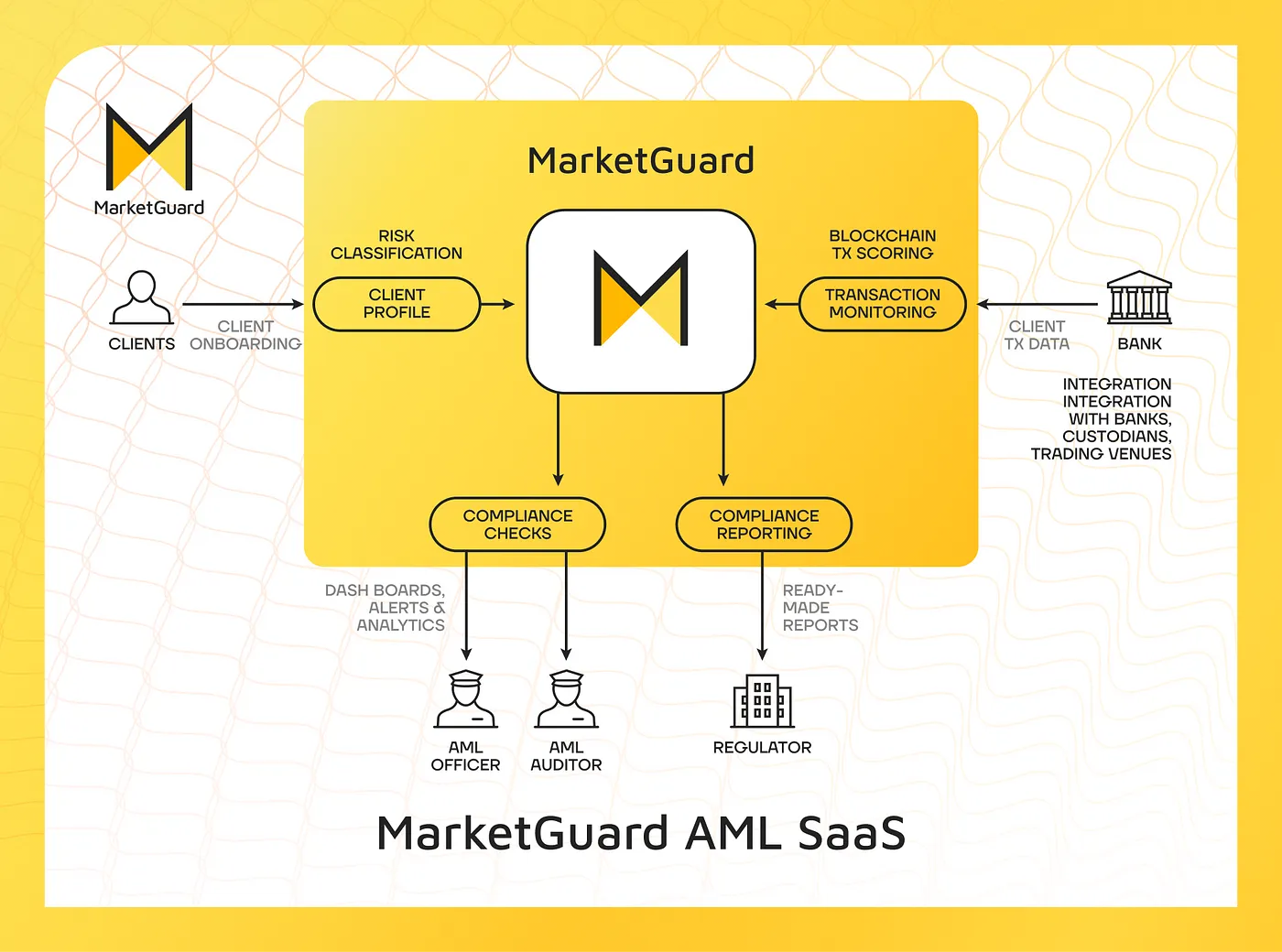

This article explores the convergence of MiCA and the U.S. Corporate Transparency Act, outlining beneficial ownership reporting obligations for crypto and traditional businesses, enforcement risks, exemptions, and the need for technology-driven compliance solutions to ensure transparency and regulatory alignment.