This article explores the convergence of MiCA and the U.S. Corporate Transparency Act, outlining beneficial ownership reporting obligations for crypto and traditional businesses, enforcement risks, exemptions, and the need for technology-driven compliance solutions to ensure transparency and regulatory alignment.

Regulatory reporting

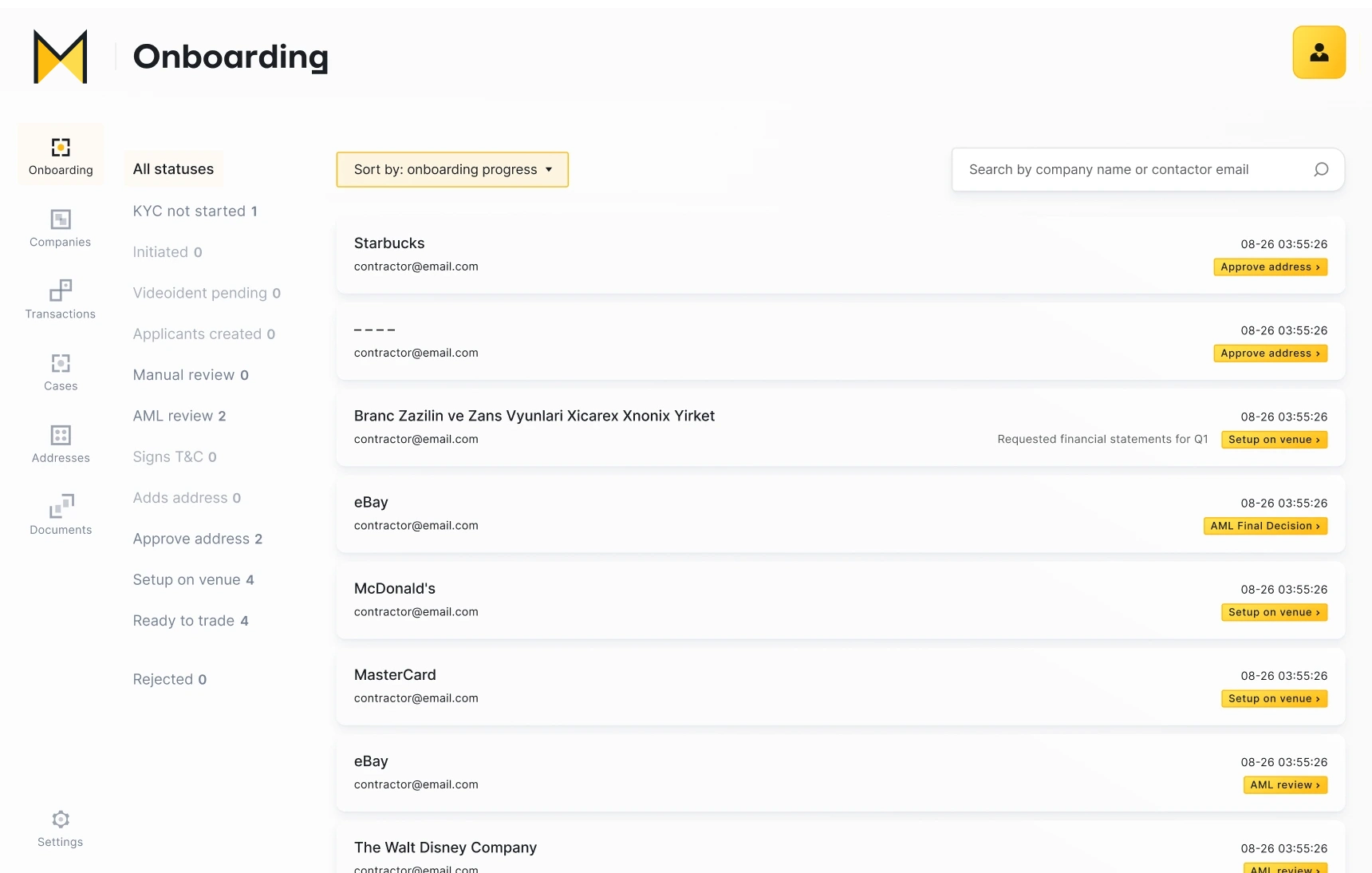

MarketGuard provides comprehensive support for regulatory reporting:

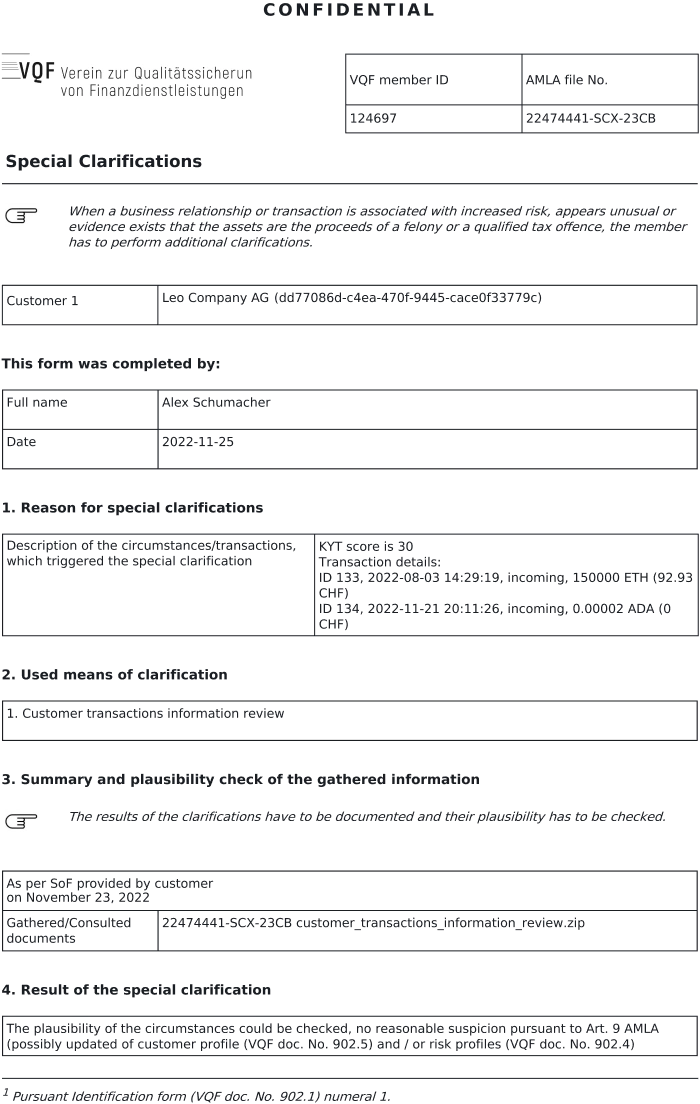

- Generate reports tailored to the specific requirements of regulatory bodies (such as VQF in Switzerland)

- Make sure regulators understand that your business is effectively monitoring and reviewing the entire flow of transactions

Our reporting system comprises data from:

- AML monitoring: detecting potential risks related to global sanctions, PEPs, and custom watch-lists, providing real-time alerts for changes in client status

- Blockchain transaction monitoring (KYT): producing a risk score based on factors such as daily/monthly limits, payment country risk, and suspicious patterns